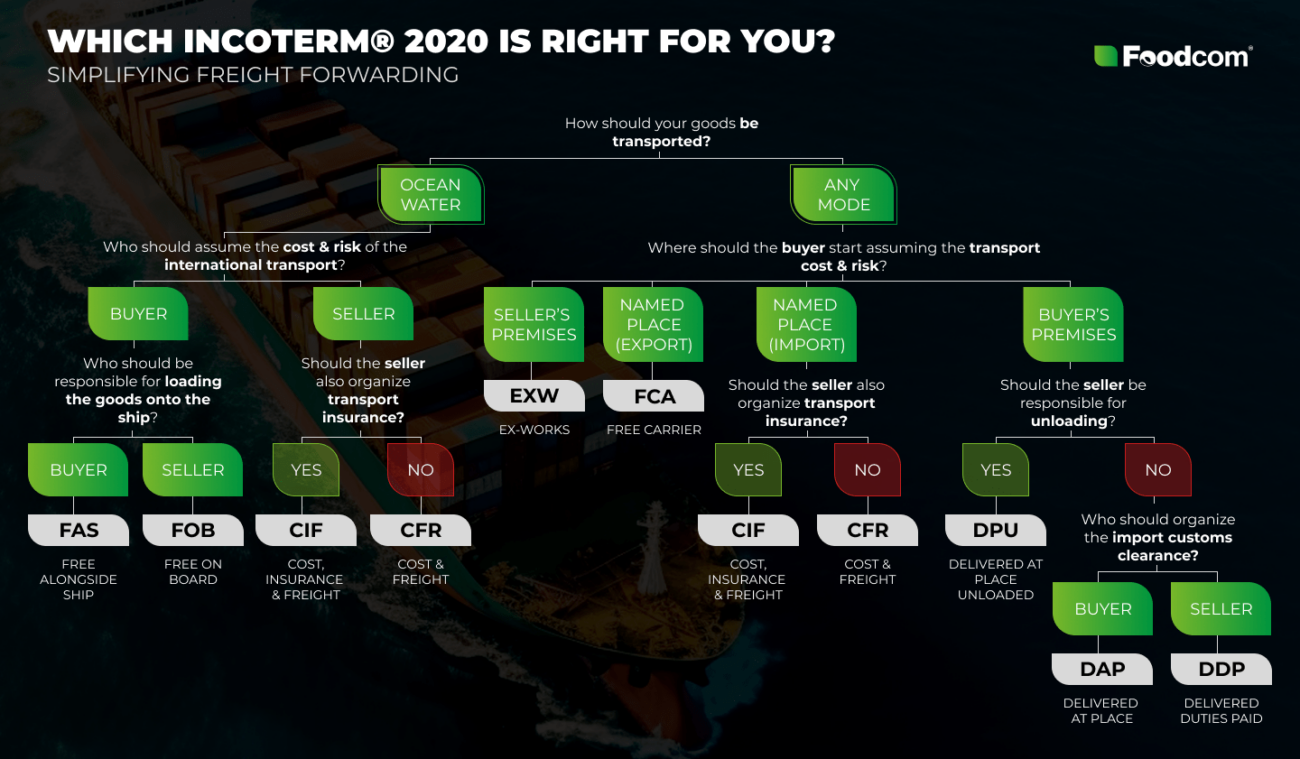

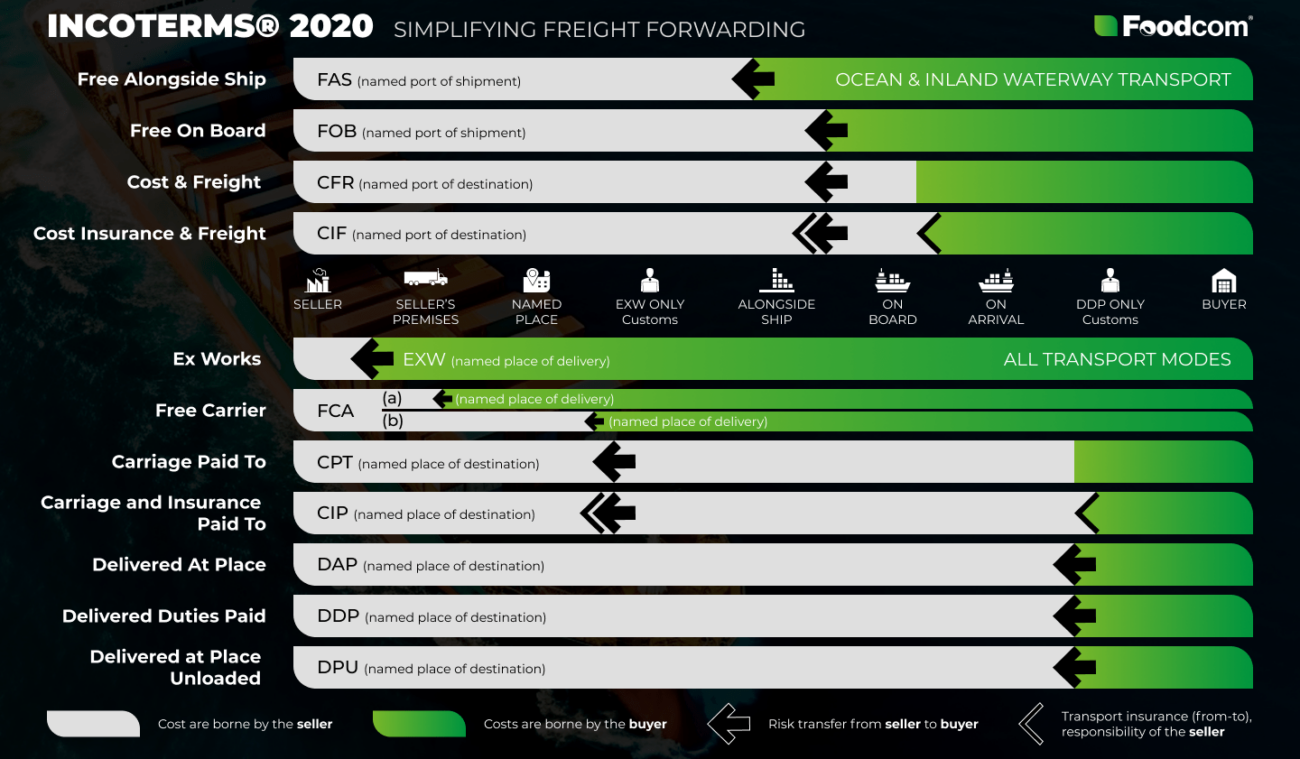

- Incoterms are international trade clauses established by the International Chamber of Commerce that explain the terms, tasks, costs and risks in the transportation of goods.

- Group C includes terms like CFR, CIF and CPT, where the seller bears the transportation costs and the risk passes to the buyer upon shipment.

- Group D includes terms like DAP, DPU and DDP, where the seller is responsible for delivering the goods to their destination.

- In Group E (EXW), the buyer bears the risk and transportation costs, and in Group F (FCA, FAS, FOB), the seller is responsible for export and the buyer for transportation.

The Incoterms® rules are a global standard that define the allocation of costs, responsibilities and risks between seller and buyer in international trade. Knowing them is essential to determine who is responsible for transport, insurance and customs formalities at various stages of the delivery of goods.

Incoterms® are divided into several groups. Rules such as EXW, FCA, FAS and FOB impose minimal obligations on the seller, transferring the risk to the buyer at an early stage of the transaction. CFR, CIF, CPT and CIP, on the other hand, mean that the seller covers the transport costs, but the risk is transferred earlier. The DAP, DPU and DDP rules require the seller to take full responsibility until the goods are delivered to their destination. Each of these rules has its own unique application, allowing flexibility to tailor the commercial terms to the needs of both parties.

EXW (Ex Works): Minimum liability of the seller

EXW is one of the Incoterms® rules, imposing minimum liability on the seller. In this model, the seller is only obliged to deliver the goods to a specific location, usually close to his warehouse. All responsibility, risk and costs associated with transport are borne by the buyer from the moment of receipt of the goods. The buyer organises transport, insurance, and covers all customs formalities.

FCA (Free Carrier): Flexibility in the choice of delivery location

The FCA principle allows for freedom in choosing the place of delivery of the goods, which is important for the contracting parties. The seller is responsible for delivery to the designated place and loading on the means of transport specified by the buyer, the risk of damage or loss of the goods passes to the buyer. Export customs formalities are the responsibility of the seller. The importer is responsible for the import and possible insurance of the goods. The costs associated with transport, once the goods have been delivered to the agreed place, are the responsibility of the buyer. FCA is a rule that combines a simple division of responsibilities with the ability to customise the place of delivery of the needs of the transaction.

CPT (Carriage Paid To): When the seller pays for transportation and the buyer bears the risk

The CPT rule from the Incoterms® formula specifies that the seller bears the cost of transporting the goods to the named place and the risk passes to the buyer when the goods are handed over to the carrier. This means that the seller organises and pays for the transport and the buyer must take care of insuring the goods himself after loading. The seller is obliged to deal with all export formalities, while the buyer takes over customs duties and other import-related costs.

CIP (Carriage and Insurance Paid To): Additional security through insurance

The Incoterms® CIP rule transfers the risk to the buyer when the carrier receives the goods. The seller is responsible for arranging the transport and insures the cargo for the buyer. The value of the insurance must be at least 110% of the value of the goods. Under CIP, the seller covers the costs of transport to the named place. Customs formalities are the responsibility of the seller. The buyer is responsible for the goods from the moment they are handed over to the carrier, bearing further risks and costs.

DAP (Delivered at Place): Delivery ready for collection, risk transferred to destination

The Incoterms® DAP rule establishes the responsibility and obligations of the seller and the buyer. According to DAP, the seller is responsible for organising and paying for transport to the place of delivery. Once the goods arrive at the destination, the risk is transferred to the buyer. The seller is not obliged to insure the goods, but may do so at his own expense. Customs formalities such as export clearance are the responsibility of the seller. Import customs procedures are the responsibility of the buyer. All transport costs up to the point of delivery are to be paid by the seller, but charges after delivery are to be borne by the buyer.

DPU (Delivered at Place Unloaded): Comprehensive delivery and unloading

The DPU rule instructs the seller to deliver the goods to the agreed place together with full unloading. Upon unloading, the risk and responsibility for the goods are transferred to the buyer. The seller covers the costs of transport, insurance and customs formalities in the country of dispatch. The buyer is responsible for customs formalities and transport costs in the country of destination. The DPU rule is one of the most comprehensive rules. It requires the seller to handle the full logistics of delivery.

DDP (Delivered Duty Paid): The seller takes full responsibility for the costs and risks

DDP is a rule that makes the seller responsible for the costs and risks involved in delivering goods to the designated place. The seller covers all transport costs, customs duties, taxes and insurance. He also completes all customs formalities. This means that the entire risk of transporting the goods lies with the seller. The buyer does not bear any additional obligations or costs. This makes the DDP method the most advantageous for the recipient.

FAS (Free Alongside Ship): Liability ends at the port wharf

The FAS rule defines the seller’s responsibility for the delivery of the goods and their export formalities until the goods are placed alongside the ship at the specified loading port. At that point, the risks and costs are transferred to the buyer. He is also responsible for loading, insurance and onward transportation. The seller does not have to organise insurance, which distinguishes FAS from other rules. The buyer assumes full responsibility for import formalities, sea transport and any additional insurance. This rule is often used in the trade of raw materials and bulk goods.

FOB (Free on Board): Risk transferred after loading to the ship

FOB is one of the most commonly used Incoterms® rules. It defines the responsibility and risk associated with the goods which passes to the buyer when the goods are loaded onto the ship at the port of shipment. The seller is obliged to deliver the goods on board the ship, bearing the costs and risks associated with the transport of the goods. Once loaded, any further costs are passed on to the buyer. The FOB rule also requires the seller to prepare the necessary export documents and clear the goods through customs.

CFR (Cost and Freight): Costs covered, risks transferred at sea

CFR is one of the Incoterms® rules. It defines the obligations of seller and buyer in international trade. According to it, the seller covers the costs of transporting the goods to the port of destination, i.e. loading, sea freight and any customs formalities. The risk is transferred to the buyer when the goods are loaded onto the ship at the port of departure. The seller is not obliged to pay for insurance, which remains with the buyer. This rule requires a precise understanding of liability and costs to avoid misunderstandings.

CIF (Cost, Insurance, and Freight): Full protection of the goods up to the port of destination

CIF is another of the Incoterms® rules. It provides full protection of the goods up to the port of destination. The seller bears the cost of transport and insurance, protecting the cargo in the event of damage or loss during transport. Risk passes to the buyer when the goods are loaded onto the ship. The seller is obliged to pay the freight and export formalities, while the costs of unloading and further transport are borne by the buyer.

Cooperation with Foodcom S.A.

Each of the eleven Incoterms mentioned differs from each other and has its own specific application. The food industry places high demands on storing goods in ideal conditions, which can make the supply chain challenging. Our sales team, supported by experienced logistics professionals, carefully selects the most suitable transport methods. At Foodcom, we always aim to work with our customers under the best possible conditions. We are ready to find a solution to any problem. Get in touch with us!