- In 2025, Ceylon cinnamon is growing in importance as a premium raw material, especially in the organic, clean label, and supplements segments.

- Stricter requirements for safety, traceability, and quality documentation favor large, well-organized suppliers.

- The global market is growing steadily, with value growing faster than volume, driven by a greater share of higher quality products and processed forms of the raw material.

The year 2025 brought the cinnamon market a period of marked normalisation after several years of very dynamic growth. After a pandemic boom in home cooking, functional beverages and ‘wellness’ products, as well as strong spikes in raw material prices, the market has moved into a phase of more stable, predictable development. Figures for 2024 indicate that global cinnamon consumption reaches around 290-300,000 tonnes, with a market value oscillating around USD 1 billion. Volume is growing moderately, while in value terms the market is recovering from the price correction of 2022-2023.

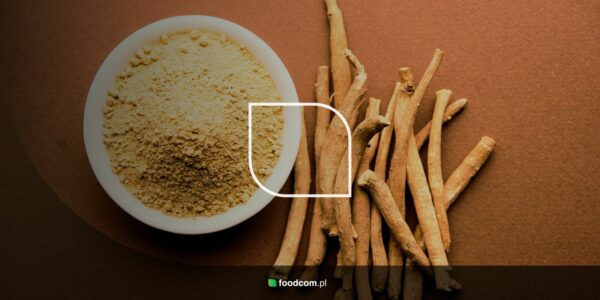

The supply structure remains highly concentrated, with the key producers being China, Vietnam, Indonesia and Sri Lanka, accounting for the vast majority of global production. It is Sri Lanka, despite its relatively small share of volume, that plays an important role in the premium segment thanks to its production of Ceylon cinnamon, which is gaining ground again in 2025 as interest in higher-quality, low-coumarin natural products increases.

On the demand side, not only traditional consumers in Asia, but also high-margin markets are growing in importance: USA, European Union, Gulf countries and Mexico. The premium segment is growing particularly strongly in these regions, where Ceylon cinnamon is gradually building recognition as a more fine, pure and better documented raw material.

2025 is also a time of heightened regulatory vigilance. Following high-profile cases of heavy metal contamination in cinnamon-containing products, publicised particularly in the US, the industry has come under tighter scrutiny. Greater requirements for laboratory testing, traceability and quality documentation have become a regular feature of the market game, favouring larger, better organised suppliers. In practice, this trend also favours Ceylon cinnamon, whose supply chain is traditionally more structured than that of cassia.

Global cinnamon market analysis

At a global level, the cinnamon market in 2025 can be described as mature but still growing. Estimates show a few percent annual volume growth over the last decade and a markedly faster market value growth. This is due to the increasing share of premium products: Ceylon cinnamon, organic variants and raw material with additional quality certificates.

On the supply side, the dominance of Asia is clear. China, Vietnam, Indonesia and Sri Lanka together account for virtually the entire global volume. The key differences are not only in terms of price, but also in terms of positioning: Chinese and Indonesian cassia are the base for bulk products, while Ceylon cinnamon from Sri Lanka is building the ‘real cinnamon’ segment, associated with quality, a finer flavour profile and a higher price. In 2025, some consumers, especially in the organic and ‘clean label’ segments, are beginning to clearly prefer Ceylon due to its sensory profile and low coumarin content.

The demand structure is clearly changing. In addition to traditional culinary uses, applications in functional foods, dietary supplements and cosmetics are increasing. Cinnamon is appearing in products that support glycaemic control, in ‘health & wellness’ drinks, protein bars or ‘additive-free’ spice blends. This shifts the centre of gravity from a cheap raw material to a higher value-added ingredient. In this context, Ceylon cinnamon gains an advantage in applications that require a more subtle aroma or higher transparency in the supply chain.

Organic and fair-trade cinnamon is becoming a separate category. Demand for this type of raw material is growing faster than the overall market, especially in Western Europe and North America. For producers, this means meeting stricter cultivation and processing requirements, but at the same time offers the possibility of sustainably higher prices. Ceylon is a natural beneficiary of this trend – a large part of its supply goes precisely to the organic and premium markets.

Regional analysis of the cinnamon market

On a regional basis, the cinnamon market reveals clear differences in demand patterns, quality preferences and import dynamics.

Europe

Europe remains primarily an import market, but with a high added value. Germany, Italy, the Scandinavian countries and Central and Eastern Europe are the most important, where cinnamon has a strong presence in bakery, confectionery, festive products and in dairy drinks and desserts.

In 2025, demand in the region is stable with a slight upward trend, with a clear shift towards ‘clean label’ and organic products. Retail chains and private label manufacturers expect full batch documentation from suppliers and, following contamination cases in the US, internal quality control standards have also been tightened in Europe. There is an increasingly clear division into three segments: cassia for bulk use, Ceylon cinnamon as a premium product and organic cinnamon, often combined with fair-trade and low environmental footprint claims.

Asia

Asia is the centre of the global cinnamon market. It is where the vast majority of the raw material is produced, while many countries in the region are large consumers. China, Vietnam, Indonesia and Sri Lanka combine the role of exporters and domestic markets.

Vietnam has grown into a modern export hub in recent years – raw material from the region goes for processing, sorting and further export in a more processed form. India, Indonesia, Pakistan or Bangladesh are increasing consumption at both household and food industry level. Within the region, Sri Lanka maintains a strong position in the premium segment and the limited supply of Ceylon further strengthens its price positioning.

North America

The United States and Canada remain one of the most attractive markets for cinnamon. Here, the raw material finds its way into both traditional applications (breakfast cereals, bakery, confectionery) and modern categories: functional beverages, ‘better-for-you’ snacks and dietary supplements.

This market is at the same time the most sensitive to safety issues. Following publicised cases of contamination in cinnamon-containing products, the US FDA has tightened controls, and retail chains and private labels have shifted the onus to denser laboratory testing and full traceability of origin to suppliers. For exporters, this means higher entry costs, but also potentially higher and more stable margins for those who comply, including suppliers of Ceylon, a particularly popular choice for premium products and supplements.

Latin America

Latin America is a growing market, although still smaller than the US or Europe. Mexico remains the most interesting destination, being one of the leading importers of cinnamon, with a strong tradition of culinary use of this spice in drinks, desserts and everyday cooking.

Across the region, cinnamon’s contribution to the food industry is growing – particularly in spice blends, sauces, confectionery and flavoured drinks. The modernisation of retail and the rise of private brands are encouraging quality standardisation and a greater role for large importers and packagers. There is also growing interest in Ceylon cinnamon in the premium niche, although it still accounts for a small proportion of imports.

Middle East and North Africa

Countries in the Middle East and North Africa are heavily dependent on cinnamon imports from Asia. In Saudi Arabia, the UAE, Iran or Egypt, cinnamon is an important part of traditional cuisine and modern gastro, and per capita consumption in some countries in the region is much higher than the global average.

The market is highly sensitive to freight prices and the dollar exchange rate, with the share of individual countries of origin in imports changing depending on cost conditions. On the other hand, there are increasing requirements for halal certification and, in the premium segment, also bio and fair-trade. Here too, Ceylon cinnamon is finding its place – especially in high-end products aimed at the premium foodservice and premium retail brand segments.

Trends and forecasts for 2026

The most important development in 2025 is the transition of the cinnamon market from a boom phase to a stable, sustainable growth phase. Demand continues to grow, but not at an explosive rate – driven primarily by higher value-added segments such as functional foods, supplements and premium products.

Forecasts for 2026 indicate a continuation of moderate volume growth with faster market value growth. In the baseline scenario, global consumption is assumed to grow by several per cent per year and market value at an even higher rate, thanks to a higher share of Ceylon cinnamon, organic variants and processed forms of the raw material (extracts, oils, standardised ingredients). Prices are likely to remain relatively stable relative to 2023-2024 levels, with more growth potential in the premium segment than in mass cassia.

The second key trend is the consolidation of high safety and traceability requirements. A series of contamination cases has made the criterion of quality as important as price for large customers in the US and Europe. This benefits producers and exporters, who invest in certifications, batch tracking systems and regular laboratory testing.

The third element is the gradual professionalisation of production in the countries of origin. In China, Vietnam, Indonesia and Sri Lanka, there is a growing proportion of larger, better managed plantations and factories, often working to BRC, IFS, bio or fair-trade standards. This, on the one hand, raises the entry threshold for smaller players and, on the other, stabilises the quality and availability of raw material for global buyers, especially in premium, where Ceylon plays a key role.

“In 2025, the cinnamon market is increasingly shifting its focus from price alone to quality control, transparency of origin and predictability of supply. The stratification between mass cassia and the premium segment, which is dominated by Ceylon cinnamon, is increasingly evident. Increasing purity and traceability requirements are causing consumers to shift their priorities to parameter stability, which naturally strengthens Ceylon’s position. Its supply is inherently inelastic: Sri Lanka does not have the space to rapidly increase cultivation, and obtaining the raw material requires highly specialised labour. Therefore, any sustained increase in demand immediately translates into price pressure. At the same time, the share of freight costs in the final price is much higher for cassia than for Ceylon, further differentiating their competitiveness. The market is therefore entering a stage of clear segmentation, in which effective purchasing strategies require a separate approach to the mass part and the premium segment.”

Global Foodcom S.A. reports.

Curious about what the future holds for the cinnamon market? Discover the latest trends and insights that will shape the cinnamon industry in late 2025 and beyond. Visit our blog, where we regularly publish updates and analysis of the dairy market. Stay tuned to Foodcom S.A. for the latest news!

![Cinnamon market overview 2026 [Global Report] Cinnamon market overview 2026 [Global Report]](https://foodcom.pl/wp-content/uploads/2025/11/global-report-cinnamon-min.png)